PaySett Corporation expands its regional payments partnership with Sagicor

The real time payments (RTP) solution PayExpedite® will further expand the financial institution’s payment capabilities in Barbados under the Amazon Web Services (AWS) platform.

ATLANTA and BRIDGETOWN, Barbados, Oct. 24, 2023 /PRNewswire-HISPANIC PR WIRE/ – PaySett Corporation a global provider of payment solutions and Sagicor Bank (Barbados) announced today the launch of the bank’s new real time payments service based on the ISO 20022 messaging standard running under the AWS platform.

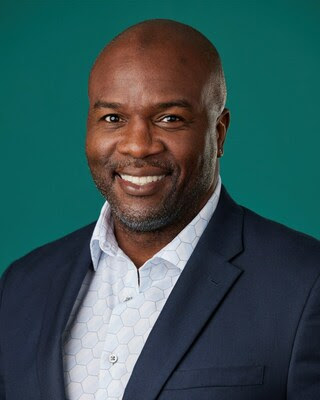

George Thomas, CEO of Sagicor Bank (Barbados) stated, “As the region’s first digital bank, we are duty bound to work with our partners to ensure that their technology posture is robust, modern, and forward-thinking. We partnered with PaySett to future proof their solution and as such we worked with them to certify their platform in the cloud. This is a mutually beneficial and monumental achievement which is the first of its kind in the anglophone Caribbean.”

Jesus Garcia VP of Business Development at PaySett Corporation added, “The Sagicor Bank real time payments implementation with our market proven PayExpedite® solution demonstrates the product’s flexibility to adapt to different operating environments of our customers while at the same time providing seamless integration with Sagicor Bank’s core banking system and origination channels, as well as the local clearing house. Our research indicates that over the coming years regional financial institutions will be looking to move some of their infrastructure to cloud platforms such as AWS in order to streamline operations and reduce costs. We are delighted to support these efforts. Additionally Sagicor Bank’s future electronic payment offerings will be backed by a world class payments engine that will complement the bank’s future strategy and is capable of supporting different types of payment services including P2P, digital wallets, eCommerce, and others for consumers, businesses, and government institutions.”

About PaySett Corporation

Atlanta Georgia based PaySett Corporation is a global provider of payment software solutions. PaySett provides products/services that allow global financial institutions to effectively manage the way money moves throughout their organizations and for their customers. PaySett’s two decades of experience moving payments through national and international payment networks has allowed for the development of advance payment software for assisting global institutions with the capability to enhance their regional and global payment network processing capabilities. Twelve of the top twenty global financial institutions process payments through PaySett software.

About Sagicor Bank (Barbados)

Sagicor Bank (Barbados) is a dynamic digital financial institution offering commercial banking services to personal and business clients. We provide unmatched benefits and convenience to clients in our portfolio supported by a diversely skilled team located in Barbados. We are leading the digital banking revolution by boldly presenting banking options that are easy-to-get, simple-to-use, safe and secure and rewarding. Find out more by visiting www.sagicor.bank, Instagram, Facebook, LinkedIn, Twitter or YouTube.

Sagicor Bank is a wholly-owned subsidiary of Sagicor Financial Company. Sagicor Financial Company Ltd. (TSX: SFC) is a leading financial services provider in the Caribbean, with over 180 years of history, and has a growing presence as a provider of life insurance products in the United States. Sagicor offers a wide range of products and services, including life, health, and general insurance, banking, pensions, annuities, and real estate. Sagicor’s registered office is located at Clarendon House, 2 Church Street, Hamilton, HM 11, Bermuda, with its principal office located at Cecil F De Caires Building, Wildey, St. Michael, Barbados. Additional information about Sagicor can be obtained by visiting www.sagicor.com

Photo - https://mma.prnewswire.com/media/2254894/George_Thomas_CEO_Sagicor_Bank_Barbados.jpg

Logo - https://mma.prnewswire.com/media/1586598/PaySett_Corporation_Logo.jpg