- Tookitaki will deploy its industry-leading Anti-Money Laundering Suite (AMLS) to help Hakrinbank detect and prevent financial crime

- The deployment to significantly improve current legacy AML system and data analysis environment

CaribPR Wire, PARAMARIBO, Suriname, Feb. 09, 2021: Tookitaki, a global regulatory technology (RegTech) company that enables financial institutions to develop sustainable compliance programs, today announced a partnership with Hakrinbank, a leading South American bank based in Suriname, to fortify its Anti-Money Laundering (AML) detection and alerts management capabilities.

To improve its legacy system and augment its ability to better detect, prioritise, investigate, report and prevent financial crime, Hakrinbank chose Tookitaki to deploy the RegTech’s cutting-edge AMLS offering into production, harnessing the bank’s unique mix of customer, account and transaction data.

In the past, the alert handling at the Hakrinbank was mainly manual because of the number of false positives (alerts that do not represent suspicious activity). The bank wanted a system that could reduce the alert volume while not increasing the risk of missing any suspicious activity. Tookitaki was selected after demonstrating superior suspicious AML pattern detection using a modern solution architecture that can replace the bank’s existing systems over time and provide a migration path for future Artificial Intelligence (AI) and Machine Learning (ML) capabilities.

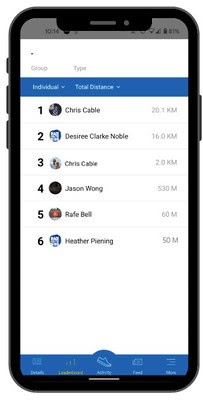

Tookitaki’s Anti-Money Laundering Suite (AMLS) is an award-winning, end-to-end, machine learning solution with modules around transaction monitoring and names screening. This solution complements current legacy systems, reduces false alerts, and detects ‘missed’ suspicious cases, augmenting both the efficiency and effectiveness of AML compliance processes. The solution will help Hakrinbank prioritize alerts smartly, use AI to increase detection accuracy and improve investigation efficiency through an easy-to-manage user interface.

Mr Abhishek Chatterjee, Founder & CEO, Tookitaki, said, “Tookitaki continues to be a trusted partner of global banks to develop sustainable compliance programmes. Working with Hakrinbank provides us inroads into the Caribbean’s dynamic financial services market. It is a great opportunity for us to detect new and emerging financial crimes, help mitigate compliance risks and ensure banks and financial institutions are aligned to regulatory compliance requirements.”

“This strategic investment and partnership with Tookitaki will enable us to lead the transformation of better risk management by shifting from conventional rules-based AML practices to a future-proof, fully-automated AI-based AML approach. Hopefully through this journey, we are also able to alter the perception of the Caribbean region as high-risk. With increasing digital transactions, fighting money laundering has become more complicated than it previously was, but we are committed to tackling this menace through this partnership,” stated Mr. Rafiek Sheorajpanday, CEO of Hakrinbank.

Last year, the European Union blacklisted a handful of Caribbean jurisdictions due to inadequate AML and tax transparency practices. However, governments in the region and regulatory bodies such as the Financial Action Task Force of Latin America (GAFILAT) are working closely to take steps to tighten anti-money laundering regulations, while in parallel financial institutions are embracing AI to improve detection and investigation abilities. The region has introduced its own initiative, such as the Caribbean Financial Action Task Force (CFATF) to improve governance.

Tookitaki AMLS is the industry’s first AI-based enterprise AML analytics solution in production across transaction monitoring and screening processes with proven performance.

About Tookitaki

Tookitaki Holding Pte. Ltd. provides enterprise software solutions catering to anti-money laundering and reconciliation spaces. Headquartered in Singapore, the growth-stage company is innovating the US$100-billion regulatory compliance space by bringing in machine learning-powered solutions that are actionable, scalable and explainable. The uniqueness and robustness of Tookitaki innovation in the field of regulatory compliance have been acknowledged worldwide. In 2020, the company won the Regulation Asia Awards for Excellence, WITSA Global ICT Excellence Award and G20TechSprint accelerator. In 2019, the company was selected as a Technology Pioneer by the World Economic Forum, recognizing its ability to shape the AML industry and the region in new and exciting ways. Tookitaki is backed by institutional investors like Viola, SIG, Illuminate Financial, Jungle Ventures and Spring Seeds, an investment arm of the Singapore government.

About Hakrinbank

The Hakrinbank, founded 85 years ago, is a full-service bank that continually strives to operate in a customer-oriented way with a primary focus on the business segment and the middle- and higher-income consumer segment. Our ambition is to be the ‘preferred bank’ for our focus customer segments through a sublime customer experience. The Hakrinbank is strongly rooted in the Surinamese society and makes an important contribution to the development of various sectors, companies, families and the society.

As one of the leading financial institutions in Suriname, Hakrinbank is working on their roadmap of providing digital and innovative products and services. Recently we launched our e-commerce platform hoppa! and our mobile wallet Mopé. Currently we are working on enhancements and new products and services such as a new Online and Mobile Banking platform.

When banks increase their digital and innovative products, it leads to an increase in cybersecurity and financial crime risks, which was one of our greatest sources of threats. Preventing fraud and money laundering requires adequate measures. Hence, strengthening our enterprise risk management framework and also creating more risk awareness has a primary focus within the organization. In that regard we have drawn up full scale Cybersecurity, Fraud and ML/TF prevention programs. Aware of our leadership position in the financial sector in Suriname, we are committed to embracing the use of Artificial Intelligence to augment our AML/CFT capabilities and to lead the way in dealing with this threat to us and our country. The partnership with Tookitaki will enable us to achieve these goals.

Hakrinbank selecciona Tookitaki para garantizar monitoreo de cumplimiento financiero sostenible

- Tookitaki implementará su Suite Antilavado de Dinero (AMLS) líder del sector para ayudar a Hakrinbank a detectar y prevenir delitos financieros

- La implementación mejorará de forma significativa el sistema Antilavado de Dinero (AML) legado actual y el espacio de análisis de datos

CARIBPR Wire PARAMARIBO, Suriname, Feb. 09, 2021: Tookitaki una empresa mundial de tecnología regulatoria (RegTech) que permite que las instituciones financieras desarrollen programas de cumplimiento sostenible, anunció hoy una asociación con Hakrinbank, un banco líder sudamericano con sede en Suriname, para fortalecer sus capacidades de detección y gestión de alertas de Antilavado de Dinero (AML).

A fin de mejorar su sistema legado y aumentar su capacidad para detectar, priorizar, investigar, informar y prevenir mejor los delitos financieros, Hakrinbank seleccionó a Tookitaki para implementar la oferta AMLS de vanguardia de RegTech en la producción, aprovechando la combinación única de datos de clientes, cuentas y transacciones del banco.

Anteriormente, el manejo de alertas e Hakrinbank era principalmente manual debido al número de falsos positivos (alertas que no representan actividad sospechosa). El banco buscó un sistema capaz de reducir el volumen de alertas sin aumentar el riesgo de desaprovechar cualquier actividad sospechosa. Tookitaki fue seleccionada después de demostrar una detección superior de patrones AML sospechosos utilizando una arquitectura de solución moderna que puede reemplazar los sistemas existentes del banco a lo largo del tiempo y ofrecer una ruta de migración a futuras capacidades de inteligencia artificial (IA) y aprendizaje automático (ML).

La Suite Antilavado de Dinero (AMLS) de Tookitaki es una solución de aprendizaje automático galardonada e integral con módulos en torno al monitoreo de transacciones y detección de nombres. Esta solución complementa los sistemas legados actuales, reduce alertas falsas y detecta los casos sospechosos “no identificados”, lo que aumenta la eficacia y efectividad de los procesos de cumplimiento AML. La solución ayudará a Hakrinbank a priorizar alertas de forma inteligente, usar la IA para aumentar la precisión de detección y mejorar la eficacia de la investigación a través de una interfaz de usuario fácil de administrar.

El Sr. Abhishek Chatterjee, fundador y director ejecutivo de Tookitaki, dijo: “Tookitaki continúa siendo un socio de confianza de los bancos globales para el desarrollo de programas de cumplimiento sostenible. El trabajo con Hakrinbank viabiliza grandes avances en el dinámico mercado de servicios financieros del Caribe. Es una gran oportunidad para detectar delitos financieros nuevos y emergentes, ayudar a mitigar los riesgos de cumplimiento y garantizar que los bancos e instituciones financieras estén alineadas con los requisitos regulatorios de cumplimiento”.

“Esta inversión estratégica y asociación con Tookitaki nos permitirá liderar la transformación de una mejor gestión de riesgos, al cambiar de prácticas de AML basadas en reglas convencionales a un enfoque de AML totalmente automatizado y comprobado para el futuro. Esperemos que a través de esta jornada, también podamos cambiar la percepción de la región del Caribe como de alto riesgo. Con el aumento de las transacciones digitales, la lucha contra el lavado de dinero se volvió más complicada que antes, sin embargo; estamos comprometidos a abordar esta amenaza a través de esta asociación “, dijo Rafiek Sheorajpanday, director ejecutivo de Hakrinbank.

El año pasado, la Unión Europea puso en la lista negra a un puñado de jurisdicciones del Caribe debido a prácticas inadecuadas de AML y transparencia fiscal. Sin embargo, los gobiernos de la región y organismos reguladores como el Grupo de Acción Financiera de América Latina (GAFILAT) están trabajando en estrecha colaboración para tomar medidas para endurecer las regulaciones contra el lavado de dinero, mientras paralelamente, las instituciones financieras están adoptando la IA para mejorar las capacidades de detección e investigación. La región presentó su propia iniciativa, como el Grupo de Acción Financiera del Caribe (GAFI) para mejorar la gobernanza.

Tookitaki AMLS es la primera solución de análisis de AML empresarial basada en IA del sector en producción a través de procesos de monitoreo y selección de transacciones con un rendimiento comprobado.

Acerca de Tookitaki

Tookitaki Holding Pte. Ltd. ofrece soluciones de software empresarial dirigidas a los espacios de antilavado de dinero y reconciliación. Con sede en Singapur, la empresa en etapa de crecimiento está innovando el espacio de cumplimiento regulatorio de US $ 100 mil millones al incorporar soluciones impulsadas por el aprendizaje automático accionables, escalables y explicables. La singularidad y robustez de la innovación de Tookitaki en el campo del cumplimiento regulatorio son reconocidas en todo el mundo. En 2020, la empresa ganó los Premios Regulation Asia a la Excelencia, el Premio WITSA Global ICT Excellence y el acelerador G20TechSprint. En 2019, la empresa fue seleccionada como pionera en tecnología por el Foro Económico Mundial, en reconocimiento a su capacidad para moldear el sector de AML y la región de maneras nuevas y emocionantes. Tookitaki cuenta con el respaldo de inversores institucionales como Viola, SIG, Illuminate Financial, Jungle Ventures y Spring Seeds, una rama de inversión del gobierno de Singapur.

Acerca de Hakrinbank

Hakrinbank, fundado hace 85 años, es un banco de servicio completo que se esfuerza continuamente por operar de forma orientada al cliente, con enfoque principal en los segmentos de negocios y de consumo de medianos y altos ingresos. Nuestra ambición es ser el “banco preferido” para nuestros segmentos de clientes focalizados mediante una magnífica experiencia de cliente. El Hakrinbank está fuertemente arraigado en la sociedad surinamesa, y hace una importante contribución al desarrollo de diversos sectores, empresas, familias y la sociedad.

Como una de las principales instituciones financieras de Suriname, Hakrinbank trabaja en su plan de acción para ofrecer productos y servicios digitales e innovadores. Recientemente lanzamos nuestra plataforma de comercio electrónico, hoppa! y nuestra cartera móvil Mopé. En la actualidad trabajamos en mejoras y nuevos productos y servicios como una nueva plataforma de banca en línea y móvil.

El aumento de productos digitales e innovadores de los bancos conduce a aumento de la ciberseguridad y riesgos de delitos financieros, una de nuestras mayores fuentes de amenazas. La prevención del fraude y el lavado de dinero exige medidas adecuadas. Bien así, el fortalecimiento de nuestra estructura de gestión de riesgos empresariales y también la creación de mayor concienciación de riesgo tienen un enfoque principal dentro de la organización. En ese sentido, elaboramos programas a escala completa de ciberseguridad y prevención de fraude y avado de dinero y financiamiento del terrorismo (LD/FT). Conscientes de nuestra posición de liderazgo en el sector financiero en Suriname, mantenemos nuestro compromiso de adoptar el uso de inteligencia artificial para aumentar nuestras capacidades Antilavado de Dinero y contra el Financiamiento del Terrorismo (ALD/CFT) y liderar el camino para lidiar con esta amenaza para nosotros y nuestro país. La asociación con Tookitaki nos permitirá alcanzar estos objetivos.

Click Here for More Information »