CARIBPR WIRE, Castries, Aug. 26, 2022: St Lucia took third place in this year’s instalment of the CBI Index – which ranked 13 countries with operational citizenship by investment programmes.

Seen as an industry voice and reliable source for those looking to vet CBI programmes around the world, the CBI Index is published annually by the Private Wealth Management magazine, a publication of the Financial Times, and in partnership with CS Global Partners.

This year, St Lucia was ranked alongside Antigua and Barbuda, Austria, Cambodia, Dominica, Egypt, Grenada, Jordan, Malta, Montenegro, St Kitts and Nevis, Turkey, and Vanuatu.

The CBI Index ranked these jurisdictions across nine pillars including Freedom of Movement, Standard of Living, Minimum Investment Outlay, Mandatory Travel or Residence, Citizenship Timeline, Ease of Processing, Due Diligence, Family and Certainty of Product.

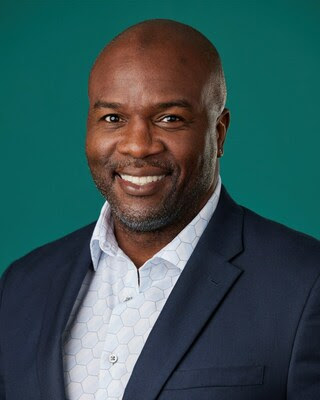

Having recently welcomed Mc Claude Emmanuel to the position of Chief Executive Officer of its CBI unit, St Lucia was recognised its affordable minimum investment outlay, reasonable mandatory travel or residence requirements and ease of application processing.

“This recognition means a lot to us. The CBI Index is a globally recognised report that has been assessing CBI programmes for the last six years and not only will investors gain insight into our programme but it also gives us an opportunity to improve aspects of our programme to increase our scores next year,” said notes Mc Claude Emmanuel, CEO of St Lucia’s CPI Unit.

Investors can become a citizen of St Lucia in as little as 90 days by investing only a minimum of US$100,000 through its National Economic Fund, and busy entrepreneurs are not required to stay in the country for prescribed periods of time.

There weren’t many significant changes in the minimum investment outlays since the 2021 CBI Index, this was reflected in no change in the order of the final scores.

There were also no changes from the 2021 CBI Index to scores under the Mandatory Travel or Residence Pillar – Caribbean nations continue to rank highly in this area.

The country scored 87% overall.

St Lucia scored 9 out of ten for Due Diligence, Citizenship Timeline, and Family.

A very important aspect of any CBI programme is its ability to vet applicants and ensure that only honest individuals who can account for how they make a living are accepted into the programmes.

“We are on an ongoing drive to continuously enhance the due diligence processes of our programme as we are very keen to protect its integrity and value,” noted Mc Claude Emmanuel.

With ongoing geopolitical tensions, special attention is now being given to jurisdictions that offer CBI programmes. The international community is concerned that these programmes may offer boltholes for suspect characters looking to evade the law.

International respect is vital for any CBI programme to thrive, and a layer of ongoing monitoring is becoming a key pillar of reputable CBI Units such as that of St Lucia. Caribbean nations are setting global best practices when it comes to advancements in due diligence processes.

The Citizenship Timeline Pillar looks at the average time taken for citizenship to be secured by the applicant. One of the key merits of CBI programmes is their ability to provide a rapid route to second citizenship; St Lucia was awarded top points for its short turnaround times, which takes three months for citizenship to be granted from the date the Authorised Agent is notified that the application has been accepted for processing.

The CBI Index recognises that the rise of increasingly complex family relationships is driving investors to seek programmes that allow for a more diverse range of family members to be included under a primary application.

As an additional layer of nuance to its scoring system, this year’s CBI Index also draws a distinction between family members who are allowed to apply with and obtain citizenship at the same time as the main applicant and those who can apply at a later stage and because of the main applicant has already received citizenship.

Multiple family member categories were considered, with points being awarded for adult children, parents, grandparents and even siblings. Additional merit was also given to programmes with provisions for family members of the main applicant’s spouse. Additionally, the degree of flexibility within each of these categories can differ radically from programme to programme.

St Lucia scored 8 out of 10 in the Certainty of Product pillar. This pillar encompasses a range of factors that measure a programme’s certainty across five different dimensions: longevity, popularity and renown, stability, reputation, and adaptability.

Longevity measures the age of a given programme while Popularity and renown evaluate the number of applications and naturalisations under each programme per year, as well as a programme’s eminence in the industry.

The reputation of a programme was determined by the amount of negative press or the number of scandals it has been linked to, affecting investors’ broader perceptions of the countries in which they invest. Just as important, however, is evidence that programme funds are being utilised for social good. Points were awarded for a jurisdiction’s transparent use of CBI funds, for example for the development of domestic healthcare, education, tourism and other infrastructure. One of the main ways that investors can become citizens of St Lucia is through its Economic Fund which Mc Claude Emmanuel has said will “benefit all St Lucians by investing in social interventions and assisting the country to be food secure as assistance will be given to local farmers.”

Lastly, adaptability reflects a programme’s ability to rapidly respond to, and sometimes even predict, the needs of applicants and the industry.

St Lucia continues to offer a popular programme with consistently high application volumes, stability with no caps on the number of applications or specific calls to end the programme, and adaptability both in respect of changes to keep the programme functioning during Covid-19 and its swift response to the Russian invasion.

St Lucia, along with Antigua and Barbuda, Dominica, Grenada and St Kitts and Nevis scored seven out of 10 in the Freedom of Movement pillar. St Lucia has access to 15 of the 20 key business hubs assessed in the 2022 CBI Index.

Lastly, St Lucia scored six out of 10 for its decent freedom, GDP growth and GNI scores.

Download the full CBI Index here, to get further insights into the CBI industry and a full evaluation of the CBI programmes of the 12 other jurisdictions in the rankings.

Click Here for More Information »